When you take on a new employee, you must register them with HMRC. This ensures that their pay and tax calculations are completed before their first payday.

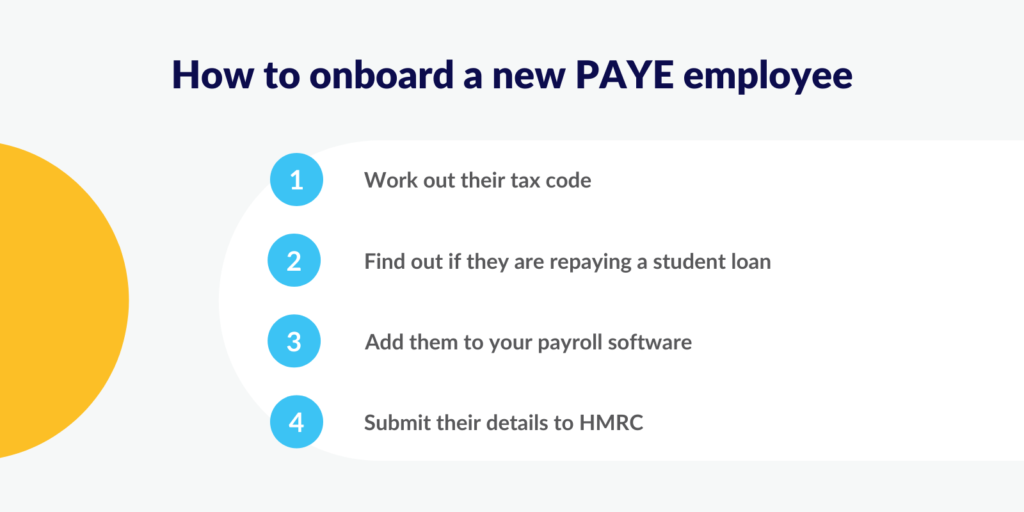

All employees paid by PAYE must be onboarded using the steps below:

- Work out their tax code

- Find out if they are repaying a student loan

- Add them to your payroll software

- Submit their details to HMRC

Ordinarily, you would get the information required from a P45. If your new starter doesn’t have one, you can get the necessary onboarding details by using the government’s new starter checklist.

What do you need to complete a new starter checklist?

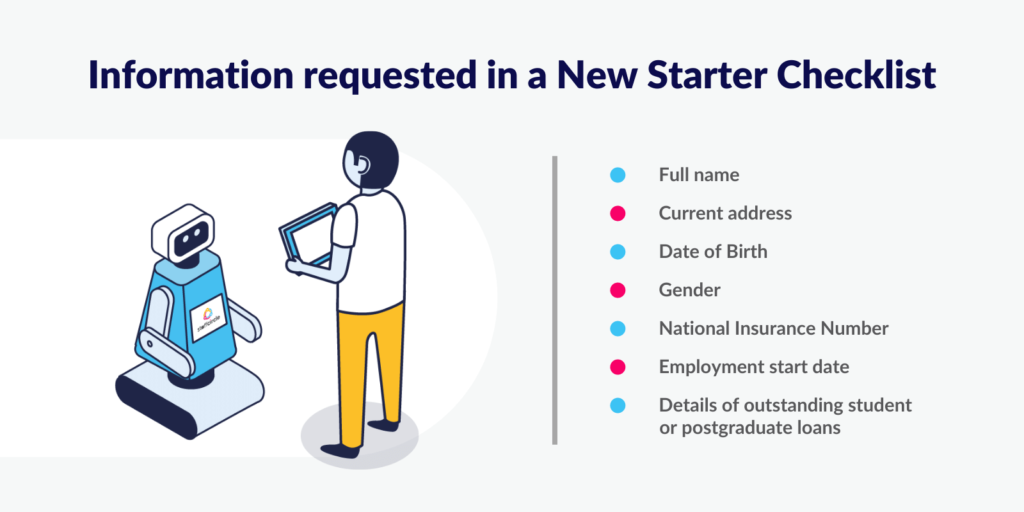

The information requested in the HMRC’s standard new starter checklist allows you to successfully onboard new hires who don’t have a P45. It includes:

- Full name

- Current address

- Date of Birth

- Gender

- National Insurance Number

- Employment start date

- Details of outstanding student or postgraduate loans

Your new employee must provide honest and accurate responses when completing the form. If they don’t, they may be assigned the wrong tax code and risk errors or overpayment.

As of April 2021, there are two options for registering new hires:

- Online. Asking new employees to complete and submit the form to you online is quick and hassle-free. Once completed, they can quickly send it directly to you as a PDF document to integrate with your HR system.

- Printed. The form is the same but can be more time-consuming. Once the new hire has received and completed their form, they must either bring it to the office or post it back. It requires manual filling in and data entry to input the details onto your HR system.

What is a P46 form?

P46 forms are no longer in use and were replaced by the current new starter checklist. However, the process and information gathered is quite similar, so many established HR professionals still use the old name.

Your employee’s P45: What is the purpose?

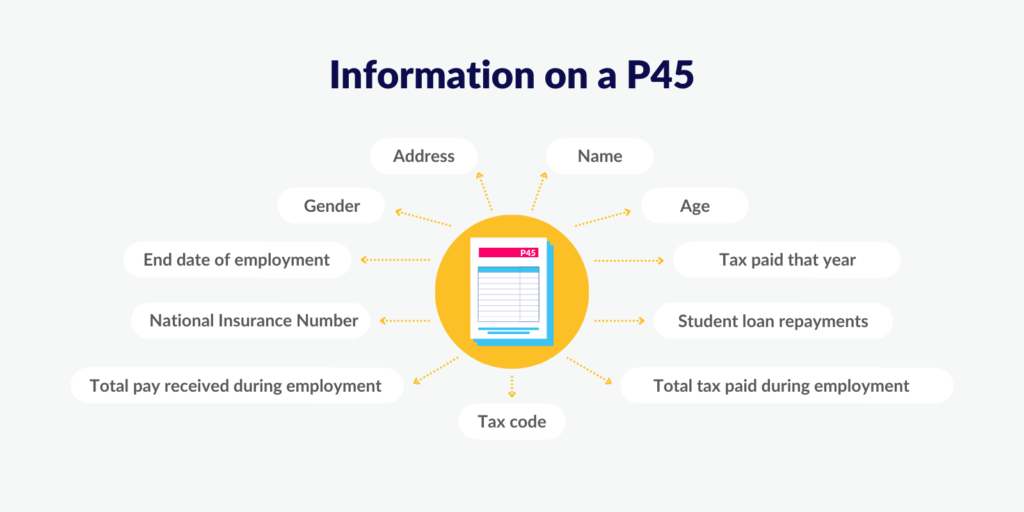

If your new employee has a P45, then they don’t need to complete a new starter checklist. The form is a comprehensive document which contains all the required data to register new hires with HMRC.

A P45 is generated when a worker leaves their previous job. No matter the reason for leaving, businesses are legally obligated to provide one. In most cases, a P45 can be generated by your payroll software.

A P45 displays:

- Name

- Address

- Gender

- Age

- National Insurance Number

- End date of employment

- Tax code

- Tax paid that year

- Student loan repayments

- Total pay received during employment

- Total tax paid during employment

If your employee has more than one P45

Employees may have more than one P45 if they previously held more than one job at the same time. Alternatively, they may have given you multiple forms if they have had multiple jobs in a short space of time.

If this happens, simply use the information from the form with the most recent end of employment date. It’ll have the most accurate information about their tax code.

If your employee does not have a P45

Once an employee has received a P45, it is their responsibility to keep it safe. If it is lost or disposed of, ordering a replacement is not possible.

Of course, accidents happen, and sometimes your new hire won’t be able to provide one. Or, they could be new to the world of work, so don’t have a previous employer at all.

The new starter checklist is available for this reason. If your new starter doesn’t have a P45, you can gather the information required to register them with HMRC from the details supplied.

Temporary or agency workers

If you employ temporary workers directly, you need to complete the PAYE enrolling process the same as you would for full-time employees. This means that they need to provide their P45 or fill in the new starter checklist as above.

However, temporary workers that you employ through an agency can be paid differently. If you pay the agency instead of the employee directly, it is the agency’s responsibility to enrol the worker with HMRC.

Employees you only pay once and secondments from abroad

If you’re employing someone for one payday only, you still add them to your payroll system, but don’t need to include a start or leaving date. Give them a payslip outlining any deductions, but you don’t need to provide them with a P45.

For employees seconded from abroad, first, check whether they are still going to be paid through the foreign branch of your company. You still need to pay PAYE tax on their wages and must factor in their residential status and how long they are going to be in the UK.

Work out your employee’s tax code

Once you’ve received the necessary information from the new starter checklist or a P45, you must assign them the correct tax code. If you don’t have a completed new starter checklist, you’ll have to apply an emergency tax code.

There’s no need to manually assign each new employee the correct code. There are a range of tools available, either for free on the government website or as part of your payroll software.

Find out if they need a DBS check

A DBS check (formerly known as a CRB check) is a way of making sure that your new employee has no legal implications that make them a liability.

The role your new employee will be carrying out will determine whether they need checking. There are four levels of DBS check available, and they can take several weeks to complete.

- Basic (£18): Suitable for employees that come into contact with the public, such as retail workers. It contains details of any unspent convictions from the Police National Computer (PNC).

- Standard (£18): A slightly more comprehensive check recommended for employees working in positions of trust, such as security or financial services. It contains details of both spent and unspent convictions from the PNC, including cautions, reprimands, and final warnings.

- Enhanced (£38): A requirement for any employees working with children or vulnerable adults. It contains the same information as the standard, alongside information held by police forces.

- Enhanced with a Barred List check (£38): A requirement for teachers and healthcare workers in regulated workplaces. This is the most detailed report, containing all the information from the enhanced check, coupled with information on whether the employee is barred from certain roles.

*Costs and full details from GOV.UK website, accurate as of April 2022.

In summary

When taking on a new employee, getting the information needed to register them with HMRC can be done in two ways.

If your new employee has a P45 from their previous job, you can simply input the information into your HR software. If they don’t, they will need to complete a new starter checklist to give you the necessary details to calculate their tax.